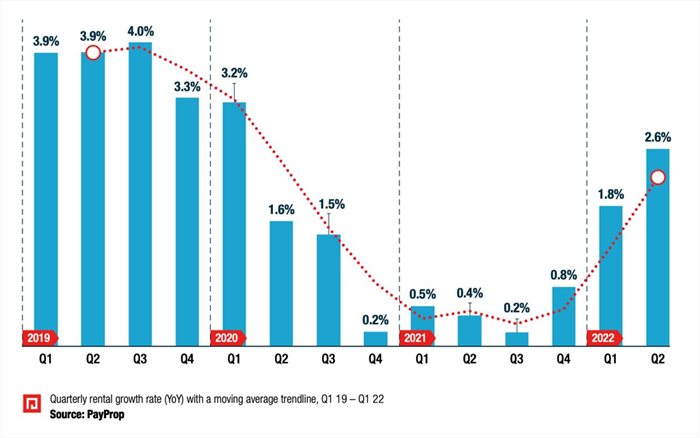

For the first time since Q3 2017, almost five years ago, the second quarter of 2022 also saw all nine provinces record positive year-on-year rental growth.

In the Northern Cape, the average rent increased by 9% year on year in Q2 2022, by far the highest out of all nine provinces. This figure finished at R8,626 – up R715 from the R7,910 recorded in Q2 2021, allowing the Northern Cape to retain its spot as the second most expensive province in which to rent.

The Western Cape remains the most expensive province for tenants in South Africa with an average rent of R9,462 in Q2 2022, up from R9,185 in the same quarter the year before. The province recorded rental growth of 3.0%, outperforming the national average of 2.6% for a fifth consecutive quarter.

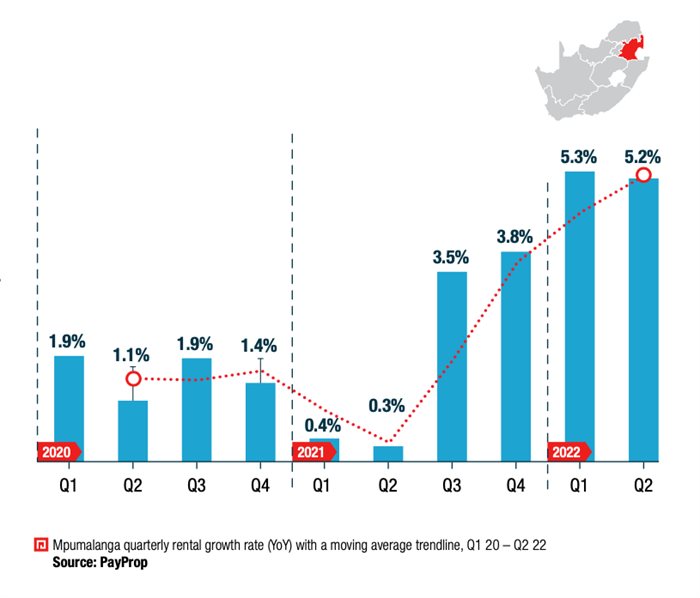

Further North, the moving average trendline in Mpumalanga shows steep upward growth over the last year. The province recorded rental growth rates above 3% in the last four quarters and outperformed the national average by far. Smuts says that during the most recent quarter, the province achieved growth of 5.2%, the second highest rate in the country.

“Average rents in Mpumalanga rose to R7,870 in Q2 2022, up from R7,484 over the corresponding period the year before. Continued strong performance could see the province overtake the national average, currently at R7,971, by the end of next year.”

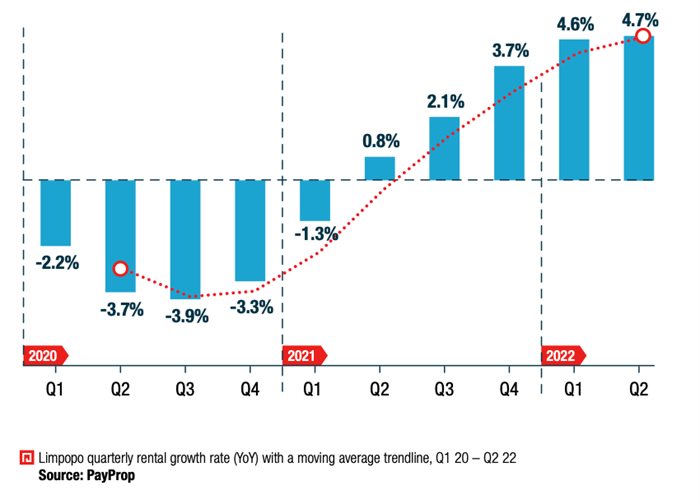

The winning streak continues in Limpopo with year-on-year rental growth of 4.7% recorded in Q2 2022. The province experienced the third highest rental growth of any province this quarter, with average rent increasing from R7,017 in Q2 2021 to R7,350 in Q2 2022. Smuts says Limpopo came off 14 consecutive quarters of negative rental growth up until early 2021 and has seen an impressive turnaround since.

“Rental growth in the province has outperformed the national average every quarter since Q2 2021, although looking at the trend line, it appears that it might now be levelling off.”

On the topic of tenant payment risk, Smuts cautions that high levels of inflation and increasing interest rates continue to put pressure on tenants’ already strained financials. “The continued financial demands faced by consumers as we move through 2022 could force those in the rental market to seek out cheaper accommodation options, which would prevent a complete rental market recovery,” says Smuts.

“On the other hand, higher interest rates and a reduced ability to save may mean that some higher-income tenants decide to keep renting instead of buying their own properties, which will have the opposite effect.”

Smuts says that although we’ve seen continued recovery of the rental market in the second quarter, agents and landlords should continue to remain mindful of the negative effects on a tenant’s ability to pay their rent. “The challenge for rental agents over the next few months will be to monitor their portfolios for signs of growing arrears, use the tools available to them to recover late payments where necessary, and vet all applicants carefully,” says Smuts.

Access the full report here.