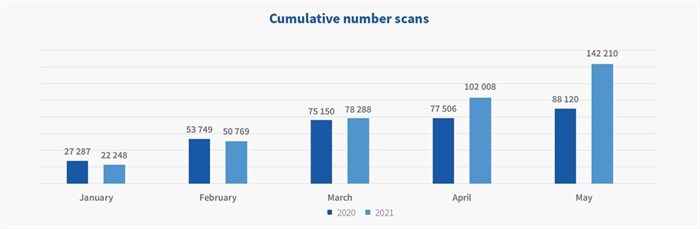

“The scans on our platform – which indicate an ‘intention to sell’ – suggest momentum in the market has recovered to pre-Covid-19 levels,” says Pieter Wessels, managing director of Lightstone Auto. “The scans on Live were 61.38% higher for the five months to end May 2021 as opposed to the corresponding period last year, when a shell-shocked South Africa was emerging from the hard lockdown.”

Wessels adds that although the start to 2021 was slow, with cumulative volumes at the end of March 2021 just 4.18% higher than the corresponding period in 2020, scans rocketed in May 2021 and were more than 300% up on 2020. This strong May performance laid the foundation for the improvement over the five-month period.

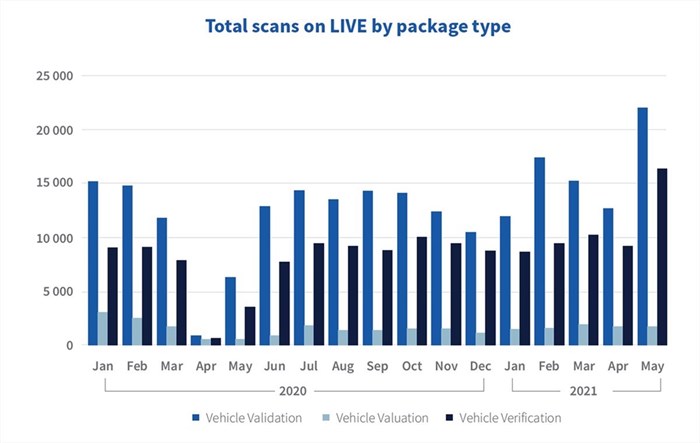

Scans on Live are broken down into three distinct products – Verification, Valuation and Validation. As indicated in the graph below:

Vehicle validations increased dramatically in February 2021, up 44.4% on January 2021. This surge came after Validations tapered off towards the end of 2020 after the post-lockdown strong recovery earlier in the year.

Vehicle verifications have grown more consistently since lockdown, and by May 2021 were ahead of pre-Covid-19 levels.

Vehicle valuations make up a smaller portion of the LIVE scans and are slowly edging back to pre-Covid-19 levels.

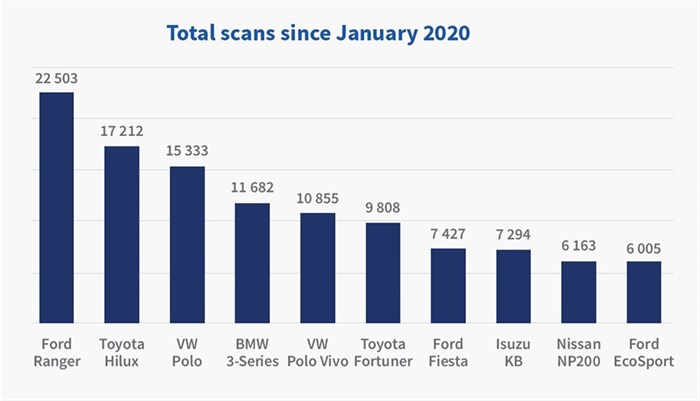

The information also drills down into the most significant brands in the South African market. The data indicates that the Ford Ranger is the most popular vehicle in the used market, and naturally, eight of the vehicles on the list also feature on the best-selling new vehicle sales charts (below) from January 2020 to May 2021.

The presence of the BMW 3-Series on the “Total scans since January 2020,” (see above graph) possibly indicates an increased willingness to sell vehicles from premium brands and move into either smaller, cost-effective vehicles or crossovers as seen below.

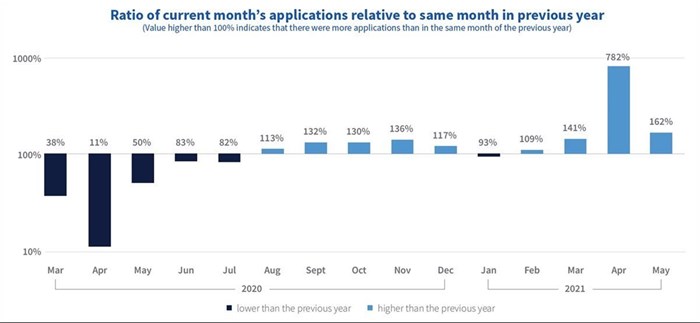

Commenting on data collected on Signio - Lightstone Auto’s flagship online platform -, Wessels says: “We observed a strong decline in total applications in the first half of 2020, with March and April being the months that were hardest hit by the Covid-19 lockdown. There was a quick recovery back to pre-Covid levels in terms of Signio applications, with every month from August to December registering higher application volumes than in the previous year. By September, total applications were more than 30% higher than in September 2019.”

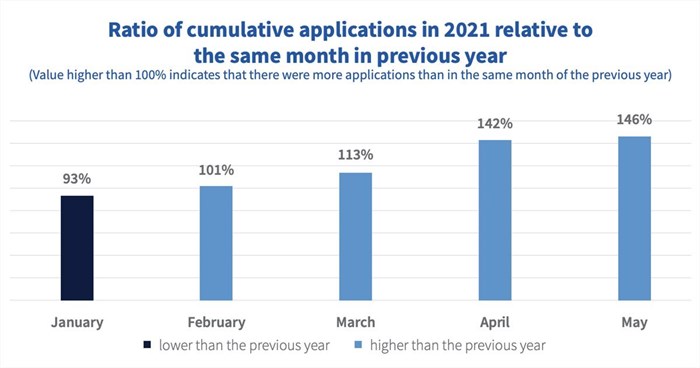

After a slow start to 2021, application volumes have continued to increase and are 41% higher in March compared to the same month in 2020 and volumes in 2021 are comparable with 2019. April 2021 showed a huge, and to be expected increase of 782% over April 2020, when dealerships were closed for most of that month.”

Wessels explains that the good growth in March has allowed Signio applications in 2021 to move ahead of 2020. Total applications are 13% higher by the end of March 2021 compared to March 2020. Total applications are at 46% at the end of May 2021 than in May 2020.

Wessels adds, “The ratio of cumulative payouts in 2021 relative to the same month in the previous year suffered a 24% decrease year on year in January but have recovered after a strong month in March and have recovered to similar levels seen in 2020.”

The data also showcases numbers for the cumulative payouts in 2021, and their steady growth in comparison to the previous year.

In conclusion, Wessels says, “We can see cumulative payouts are 38% higher at the end of May 2021 when compared to May 2020 – another indicator that the retail motor sector is regaining its momentum.”