Although this is the sixth consecutive hike in the repo rate (taking it to 6.25%), as the Reserve Bank attempts to bolster the weakening rand and dampen inflation expectations, this still remains below pre-Covid repo rate levels of 6.5%, while the prime interest rate now stands at 9.75%.

Consumers in general are feeling the strain on household income, with the food and energy price shocks earlier this year creating an inflationary ripple effect across the economy. That said, the Sarb has highlighted the fact that the key challenges facing the local economy are not the current level of interest rates and the cost of borrowing, but rather the ongoing infrastructure bottlenecks such as electricity and transport, as well as education.

The Sarb's deputy governor, Dr Rashad Cassin, recently suggested that the bank is attempting to move towards a more ‘neutral’ interest rate setting and would be attempting to avoid dampening economic activity as much as possible.

The MPCs recent decision was ultimately guided by the inflation outlook and its assessment of the risks of wage inflation emerging, coupled with global trends of significant interest rate hikes. While higher local interest rates will help to protect the rand, when combined with rising price pressures, they will temper domestic spending at a time when the economy is already struggling to grow, particularly given the recent return of Stage 6 load shedding.

While inflation eased to 7.6% last month (August) from a 13-year high of 7.8% in July, raising hopes that inflation has in fact peaked, the Reserve Bank’s role is to contain inflation, by bringing inflation and inflation expectations back to the 4.5% inflation target mid-point (within the target range of 3-6%) as a precondition for sustainable economic growth.

The MPC is particularly concerned about anchoring inflation expectations to avoid external price shocks - such as recent food and energy prices - from becoming entrenched and filtering through to price setting in the broader economy.

Once it is clear that price pressures are subsiding again, it will be possible for the bank to shift gear to a slower pace of interest rate hikes. The Sarb has hiked rates by 275 bps since November 2021 and it is hoped that we may only see two further smaller rate increases, bringing the prime rate to 10.5% and an end to the current tightening cycle.

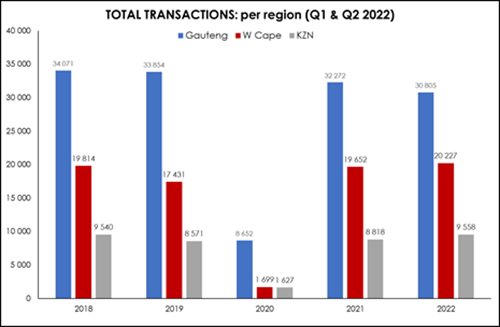

Despite the rising trend in interest rates since late-2021, activity in the housing market has remained remarkably resilient thus far, with recent data from Lightstone showing that while unit sales during the first half of 2022 were marginally below those recorded during the same period last year, the value of those sales was higher. Looking at the regions, the semigration trend saw the Western Cape record a higher number of sales during the first half of this year compared to the previous four years.

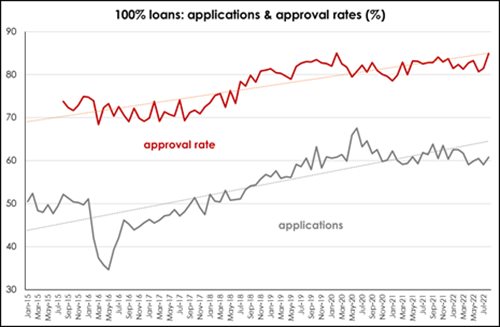

On the plus side, particularly for first-time home buyers, SA’s financial institutions appear to be maintaining their appetite for extending mortgages, despite requiring slightly larger deposits as a percentage of the purchase price. According to Ooba, deposits reached a low of 5.3% of purchase price in March this year, but have risen steadily since then, reaching 9.6% in August.

However, the pricing of those loans continues to improve, also according to Ooba, with the average rate of concession at 0.32% in August – a marginal improvement on the previous four months when the average rate remained steady at -0.3%. This is the best rate available since mid-2010, and reflects the competitive environment among the banks for mortgages.

Furthermore, after declining for several months, at fairly elevated levels, approval rates ticked higher in August both overall and for first-time buyers. Although the demand for 100% loans has flatlined for some time now, approval rates also ticked higher in July and August – at 85.95% in August, the approval rate is the highest since February 2020.

While the current rising interest rate environment and the pressure on household disposable income from renewed price pressures are headwinds for the housing market, the fact that banks retain their appetite to extend mortgages provides the market with a solid underpinning. It is advisable to also bear in mind that it is anticipated that we are nearing the end of the repo rate upward cycle, and that over decades, residential property has retained its appeal as a sound medium to long-term investment.