EU says international companies got 'illegal state aid'

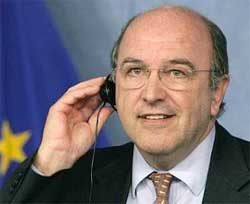

"In the current context of tight public budgets, it is particularly important that large multinationals pay their fair share of taxes," EU Competition Commissioner Joaquin Almunia said.

Apple and Starbucks - as well as a number of other multi-national companies including Amazon and Google - have come under intense pressure from politicians and campaigners over their tax affairs.

The tax policies ruling the financial arm of Italian car manufacturer Fiat, based in Luxembourg, are also included in the probe.

The multi-nationals are accused of enjoying sweetheart tax deals that allow them to move billions in earnings from higher-taxed countries to lower taxed ones.

Transfer pricing payments

Almunia said the investigation would focus on transfer pricing payments, an accounting technique where units of a multi-national pay 'royalties' to another unit of their business.

The mechanism - made possible by carefully crafted tax laws in Ireland, Netherland and Luxembourg - allow operations in higher-taxed countries to post losses, with profits moved elsewhere.

The European Union strictly has no jurisdiction over national tax policies, a cherished prerogative of member states and must limit its investigation to rules governing free competition.

Almunia said the arrangements under scrutiny could amount to illegal state aid that discriminated against other member states.

"Under the EU's state aid rules, national authorities cannot take measures allowing certain companies to pay less tax than they should if the tax rules of the member state were applied in a fair and non-discriminatory way," Almunia said.

Moving money to avoid tax

California technology company Apple has shifted billions in international earnings through Ireland using such loopholes, but the government said it had not breached EU rules.

"Ireland is confident that there is no breach of state aid rule in this case and we will defend all aspects vigorously," a government spokesman said.

Facing an international firestorm, Ireland last year moved to close the loophole, but still firmly defends its 12.5% corporate tax rate.

Last year Apple Chief Executive Tim Cook faced a grilling by US lawmakers on "sham" subsidiaries used to shift profits offshore, though he denied the company uses "gimmicks" to cut taxes.

Starbucks, which has it headquarters in tax-friendly Netherlands, said it would take a closer look at the EU probe, for which it is only indirectly a target. But in the face of a public backlash over its tax practices, Starbucks in April said it was relocating its European headquarters from The Netherlands to Britain.

Last year it agreed to pay £20m in British corporation tax, adding it had "listened" to its customers. In 2012 Starbucks acknowledged it had not paid corporation tax in Britain on sales worth £400m between 2009 and 2012.

"We comply with all relevant tax rules, laws and OECD guidelines and we're studying the Commission's announcement related to the state aid investigation in The Netherlands," a Starbucks spokesman said.

In a letter to Parliament, The Netherlands government said it would "of course" cooperate with the EU probe.

"I am convinced that the investigation will conclude that this is not state aid and that agreements with Starbucks respect OECD rules on tax deductions," said Eric Wiebes, State Secretary of Finance.

Source: AFP via I-Net Bridge